-

-

Lunch & Learn - Georgia Tax Credit info from The Quantum Group

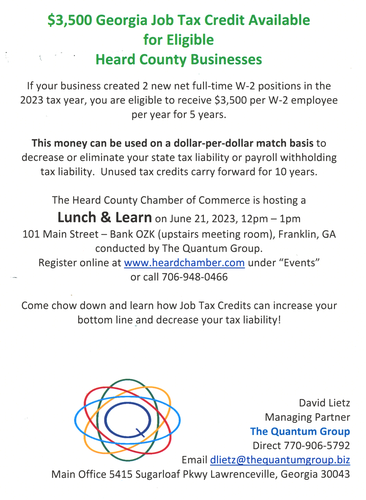

Name: Lunch & Learn - Georgia Tax Credit info from The Quantum GroupDate: June 21, 2023Time: 12:00 PM - 1:00 PM EDTWebsite: www.heardchamber.comRegistration: Sorry, public registration for this event has been closed. Lunch & Learn - GA Job Tax CreditEvent Description:$3,500 Georgia Job Tax Credit Available

Lunch & Learn - GA Job Tax CreditEvent Description:$3,500 Georgia Job Tax Credit Available

for Eligible Heard County Businesses

If your business created 2 new net full-time W-2 positions in the 2023 tax year, you are eligible to receive $3,500 per W-2 employee

per year for 5 years.

This money can be used on a dollar-per-dollar match basis to decrease or eliminate your state tax liability or payroll withholding

tax liability. Unused tax credits carry forward for 10 years.

The Heard County Chamber of Commerce is hosting a Lunch & Learn on June 21, 2023, 12pm – 1pm,101 Main Street – Bank OZK (upstairs meeting room), Franklin, GA, conducted by The Quantum Group.

Register online at www.heardchamber.com under “Events” or call 706-948-0466

Come chow down and learn how Job Tax Credits can increase your bottom line and decrease your tax liability!Location:101 Main Street – Bank OZK (upstairs meeting room), Franklin, GADate/Time Information:June 21, 2023, 12pm – 1pmContact Information:706-948-0466Fees/Admission:Free at attend, Lunch is provided free. Please RSVP.Set a Reminder:

-

103 Main Street

P. O. Box 368

Franklin, GA 30217

706-948-0466

-

News and Events

-

News & Events

-

News & Events

-

Heard County

Chamber of Commerce, Inc.

103 Main Street | PO Box 368 | Franklin GA 30217

(706) 948-0466

info@heardchamber.com

Site by ChamberMaster.

© Copyright 2011-2015 Heard County Chamber of Commerce.

All rights reserved. -

-w601.jpg)

.jpg)

.jpg)